Gradient Trader - A CryptoCurrency Trader Powered By Deep Q-Learning

Welcome to Gradient Trader - a cryptocurrency trading platform using deep learning. We are four UC Berkeley students completing our Masters of Information and Data Science. Some of us come from a finance background, others with expertise in deep learning / reinforcement learning, and some are just interested in the cryptocurrency market. With that, we’d like to present our work to you and hope you’ll share with others that may find this blog of interest!

The popularity of cryptocurrencies has grown tremendously over the years. While it remains a highly speculative market, its mention in mainstream media, the growth of hedge funds focused solely on cryptocurrencies, and the backing of such currencies by established investors has given rise to a greater number of investors.

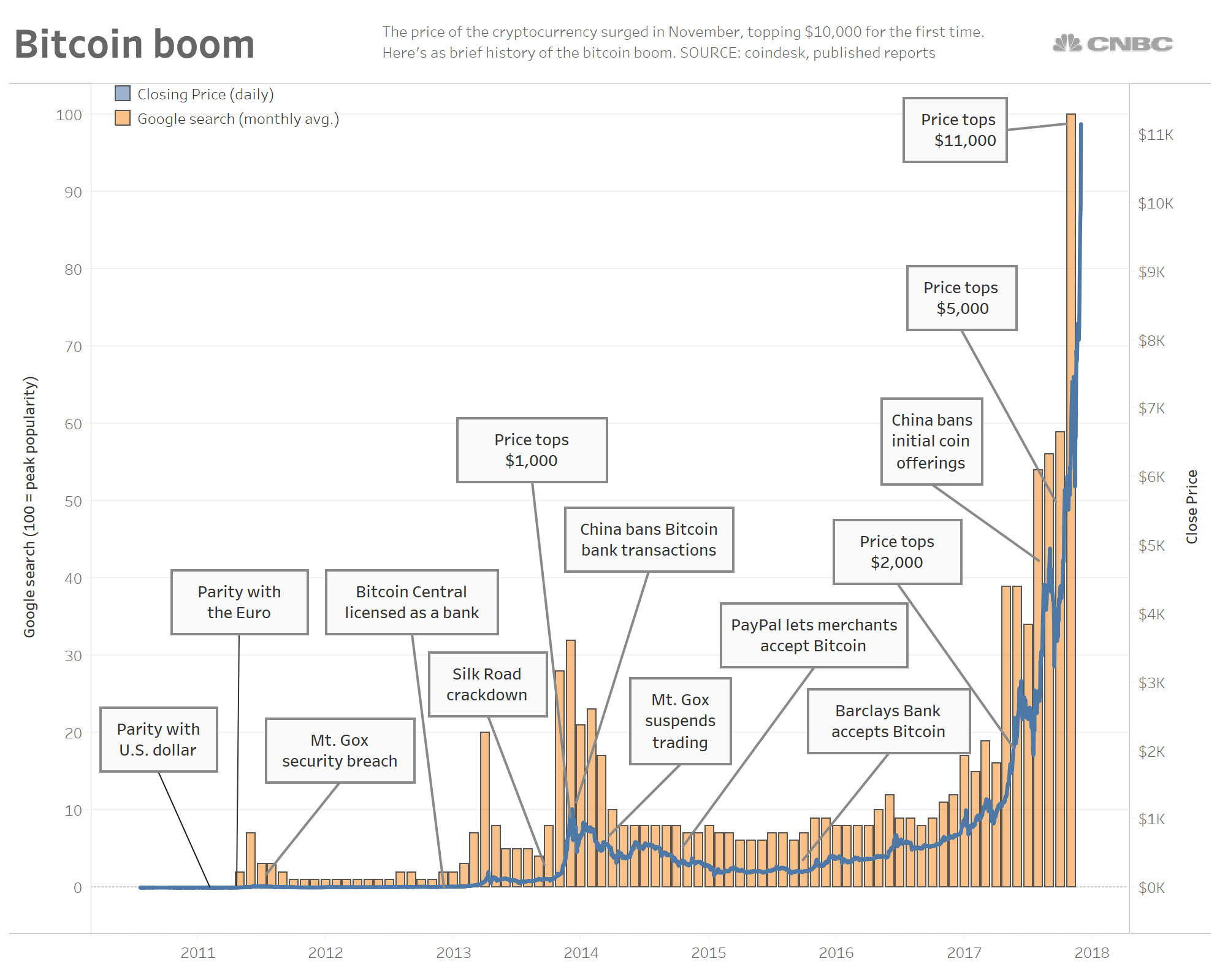

Created in the year 2009, Bitcoin was introduced as the first cryptocurrency. Since 2011, the price of bitcoin has increased by 1,100,000%, recently reaching a cost of $19,000 per coin!

Cryptocurrencies use a decentralised technology known as blockchain to let users make secure payments and store money without the need to use their name or go through a bank. Encryption techniques are used to handle transactions, allowing for anonymous exchanges between coin sellers and buyers. In short, blockchain is a network of computers that jointly manage the database to record Bitcoin transactions. This central network is part of the reason for bitcoin’s high security; any changes to the transaction records must be agreed upon by every computer on the system.

With this anonymity and lack of a centralized banking authority comes a highly volatile market. From fears of governments banning the use of cryptocurrencies, an unregulated environment prone to insider trading and “pump and dump” schemes, as well as the uncertainty of how this new form of currency will be used in the future, investing in this market and attempting to predict returns is not for the faint of heart.

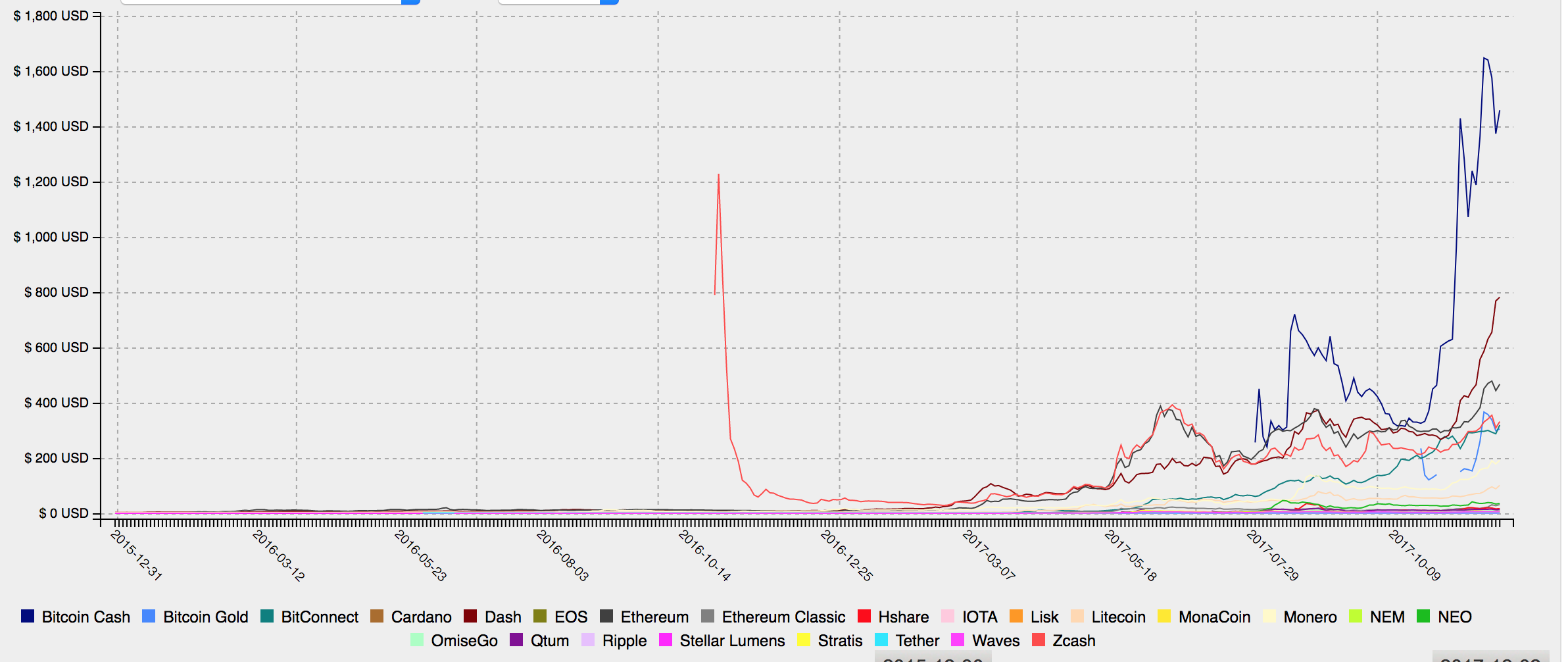

In addition to Bitcoin, there are actually thousands of alternative coins (note as “altcoins”) being released alongside Bitcoin with the promise of improved technologies, (and return on investments for those willing to purchase).

The image below shows the price overlay of top 24 alternative coins since 2016 [source: http://www.cryptocurrencychart.com/]:

Below is a list of the top 400 altcoins as of December 2017 [source: http://www.cryptocurrencychart.com/]:

With this in mind, we as data scientists see the above as a challenge to determine if there is any method to the madness that is cryptocurrency trading, and if so, can we build a model to predict that method?

Financial modeling has been in practice for decades and is a challenge for even the most well-resourced institutions, so the task of developing predictive models for this highly speculative market is no small feat. However, where there’s risk there’s reward, and if we are able to decrease that risk even a tiny amount, we would consider ourselves successful.